Abstract

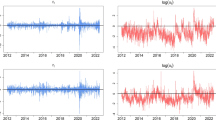

In this study, we consider the problem of detecting a change point in the conditional quantile of GARCH models. The task is essential in risk management as the conditional quantile is utilized to calculate the value-at-risk (VaR) of asset prices. We propose the cumulative sum (CUSUM) tests based on the residuals and derive their limiting distributions under mild conditions. We also demonstrate the validity of the tests by conducting Monte Carlo simulations, followed by a real data analysis of the exchange rate between the US Dollar and Korean Won and the Korea composite stock price index.

Similar content being viewed by others

References

Bai, J. (1993). On the partial sums of residuals in autoregressive and moving average models. Journal of Time Series Analysis, 14(3), 247–260.

Berkes, I., Horváth, L., & Kokoszka, P. (2004). Testing for parameter constancy in GARCH(p, q) models. Statistics & Probability Letters, 70, 263–273.

Billingsley, P. (1968). Convergence of probability measure. Wiley.

Bloomfield, P., & Steiger, W. L. (1983). Least absolute deviations: theory, applications, and algorithms. Birkhäuser.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31, 307–327.

Bougerol, P., & Picard, N. (1992). Strict stationarity of generalized autoregressive processes. The Annals of Probability, 20, 1714–1730.

Campbell, S. D. (2006). A review of backtesting and backtesting procedures. The Journal of Risk, 9, 1–17.

Chen, J., & Gupta, A. K. (2012). Parametric statistical change point analysis with applications to genetics, medicine, and finance. Wiley.

Christoffersen, P. F. (1998). Evaluating interval forecasts. International Economic Review, 39, 841–862.

Ciuperca, G. (2017). Real time change-point detection in a nonlinear quantile model. Sequential Analysis, 36(1), 87–110.

Csörgő, M., & Horváth, L. (1997). Limit theorems in change-point analysis. Wiley.

de Pooter, M., & van Dijk, D. (2004). Testing for changes in volatility in heteroskedastic time series—A further examination. Econometric Institute Research Papers EI 2004-38, Erasmus University Rotterdam, Erasmus School of Economics (ESE), Econometric Institute.

Engle, R., & Manganelli, S. (2004). CAViaR: Conditional autoregressive value at risk by regression quantiles. Journal of Business & Economic Statistics, 22, 367–381.

Engle, R. F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of united kingdom inflation. Econometrica, 50, 987–1007.

Fan, L., Glynn, P. W., & Pelger, M. (2018). Change-point testing and estimation for risk measures in time series. arXiv preprint. arXiv:1809.02303.

Fitzenberger, B., Koenker, R., & Machado, J. (2013). Economic applications of quantile regression. Springer Science & Business Media.

Gombay, E. (2008). Change detection in autoregressive time series. Journal of Multivariate Analysis, 99, 451–464.

Hall, P., & Heyde, C. C. (2014). Martingale limit theory and its application. Academic Press.

Inclán, C., & Tiao, G. C. (1994). Use of cumulative sums of squares for retrospective detection of changes of variance. Journal of the American Statistical Association, 89, 913–923.

Kim, M., & Lee, S. (2016). Nonlinear expectile regression with application to value-at-risk and expected shortfall estimation. Computational Statistics & Data Analysis, 94, 1–19.

Kim, S., Cho, S., & Lee, S. (2000). On the cusum test for parameter changes in GARCH (1, 1) models. Communications in Statistics-Theory and Methods, 29(2), 445–462.

Kirch, C., & Kamgaing, J. T. (2012). Testing for parameter stability in nonlinear autoregressive models. Journal of Time Series Analysis, 33(3), 365–385.

Koenker, R., & Bassett, G., Jr. (1978). Regression quantiles. Econometrica: Journal of the Econometric Society, 46, 33–50.

Koenker, R., & Zhao, Q. (1996). Conditional quantile estimation and inference for arch models. Econometric Theory, 12, 793–813.

Koul, H. L. (2002). Weighted empirical processes in dynamic nonlinear models. Springer Science & Business Media.

Kupiec, P. (1995). Techniques for verifying the accuracy of risk measurement models. The Journal of Derivatives, 3, 73–84.

Lee, S., Ha, J., Na, O., & Na, S. (2003). The CUSUM test for parameter change in time series models. Scandinavian Journal of Statistics, 30, 781–796.

Lee, S., & Kim, M. (2017). On entropy test for conditionally heteroscedastic location-scale time series models. Entropy, 19(8), 388.

Lee, S., & Noh, J. (2010). Value at risk forecasting based on quantile regression for GARCH models. The Korean Journal of Applied Statistics, 23, 669–681.

Lee, S., & Noh, J. (2013). Quantile regression estimator for GARCH models. Scandinavian Journal of Statistics, 40, 2–20.

Lee, S., Tokutsu, Y., & Maekawa, K. (2004). The cusum test for parameter change in regression models with ARCH errors. Journal of Japan Statistical Society, 34, 173–188.

Lee, S., Wei, C.-Z., et al. (1999). On residual empirical processes of stochastic regression models with applications to time series. The Annals of Statistics, 27(1), 237–261.

Noh, J., & Lee, S. (2016). Quantile regression for location-scale time series models with conditional heteroscedasticity. Scandinavian Journal of Statistics, 43, 700–720.

Oh, H., & Lee, S. (2018). On score vector- and residual-based CUSUM tests in ARMA-GARCH models. Statistical Methods & Applications, 27(3), 385–406.

Oh, H., & Lee, S. (2019a). Modified residual CUSUM test for location-scale time series models with heteroscedasticity. Annals of Institute of Statistical Mathematics, 71, 1059–1091.

Oh, H., & Lee, S. (2019b). Parameter change test for location-scale time series models with heteroscedasticity based on bootstrap. Applied Stochastic Models in Business and Industry, 35(6), 1322–1343.

Oka, T., & Qu, Z. (2011). Estimating structural changes in regression quantiles. Journal of Econometrics, 162(2), 248–267.

Page, E. S. (1955). A test for a change in a parameter occurring at an unknown point. Biometrika, 42, 523–527.

Qu, Z. (2008). Testing for structural change in regression quantiles. Journal of Econometrics, 146(1), 170–184.

Su, L., & Xiao, Z. (2008). Testing for parameter stability in quantile regression models. Statistics & Probability Letters, 78(16), 2768–2775.

Weiss, A. (1991). Estimating nonlinear dynamic models using least absolute error estimation. Econometric Theory, 7, 46–68.

Xiao, Z., & Koenker, R. (2009). Conditional quantile estimation for generalized autoregressive conditional heteroscedasticity models. Journal of the American Statistical Association, 104, 1696–1712.

Zhou, M., Wang, H. J., & Tang, Y. (2015). Sequential change point detection in linear quantile regression models. Statistics & Probability Letters, 100, 98–103.

Acknowledgements

We thank the editor, an AE, and the two referees for their careful reading and valuable comments. This research is supported by Basic Science Research Program through the National Research Foundation of Korea (NRF) funded by the Ministry of Science, ICT and Future Planning (no. 2021R1A2C1004009).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

We here provide a proof of Theorem 2.1 in Sect. 2. All necessary notations are introduced in Sect. 2.

Proof of Theorem 2.1

We first handle \({\hat{T}}_{n,1}\). Note that

Properly modifying the arguments used for analysing the asymptotic behavior of the sequential residual empirical process for ARMA and GARCH models (Bai, 1993; Koul, 2002; Lee & Kim, 2017; Lee et al., 1999), one can verify that \(A_n =o_P (1)\). Below we provide a condensed proof without going into great detail.

We put \(g_t (\vartheta ) {:}{=}\xi {\tilde{\sigma }}_t (\theta )/\sigma _{t0}-\xi _0\) and

For any \(\delta \in (0,1)\), there exists \(L>0\) such that \(P(\hat{\vartheta }_{n}\in {\mathcal{N}}_{L/\sqrt{n}})\ge 1-\delta\), where \({\mathcal{N}}_{L/\sqrt{n}}\) is a compact neighborhood of \(\vartheta _{0}\) with \(\|\vartheta -\vartheta _{0}\|\le L/\sqrt{n}\) for all \(\vartheta \in {\mathcal{N}}_{L/\sqrt{n}}\). For a positive real number \(\eta\), we partition \({\mathcal{N}}_{L/\sqrt{n}}\) into a finite number, say, \(N{:}{=}N(\eta )\) of subsets \(D_1,\ldots ,D_N\) with diameter less than \(\frac{\eta }{\sqrt{n}}\). We choose any points \(\vartheta _j\) in \(D_j\). Then, when \({\hat{\vartheta }}_n \in D_j\), we have

with \(g_{tj}^{-}=\inf _{\vartheta \in D_j} g_t (\vartheta )-g_t (\vartheta _j)\) and \(g_{tj}^{+}=\sup _{\vartheta \in D_j} g_t (\vartheta )-g_t (\vartheta _j )\). Put

Then,

with

Put

and \(S_{kj}^+=\sum _{t=1}^{k}e_{tj}^+\) and \(S_{kj}^-=\sum _{t=1}^{k}e_{tj}^-\) . Note that \(\{(S_{kj}^+, {\mathcal{F}}_t); k=1,\ldots , n\}\), where \({\mathcal{F}}_t=\sigma (\epsilon _t, \epsilon _{t-1},\ldots )\), forms an array of martingales. Then, for any \(\lambda >0\), using the sub-martingale inequality, we get

Furthermore, applying Rosenthal’s inequality (Hall & Heyde, 2014), we get

for some \(C>0\). Using the mean value theorem and the fact that \(E\{y_{t-1}^4 |g_t (\vartheta _j)+g_{tj}^+|\}^{p} <\infty\), we can see that \(E\Big [\sum _{t=1}^{n}E(e_{tj}^{+2}|{\mathcal{F}}_{t-1})\Big ]^{p}=O (n^{p/2})\), so that since \(\sum _{t=1}^{n}E(e_{tj}^{+2p})= O(n)\), we have \(ES_{nj}^{+2p}=O(n^{p/2}+n )\) uniformly in j by (11). This together with (10) implies \(\max _{1\le j\le N}\max _{1\le k\le n} |I_{kj}^+|=o_P (1)\). Similarly, we can check that \(ES_{nj}^{-2p}=O(n^{p/2}+n )\) uniformly in j, so that

Combining this, (8) and (9) with an arbitrarily small \(\eta\), we obtain \(A_n= o_P (1)\). Meanwhile, using Taylor’s theorem up to order 2 and the ergodicity of \(\{y_t\}\), one can easily verify that \(B_n =o_P (1)\). This with \({\hat{\tau }}_{1}^2=\tau _1^2+o_P (1)\) indicates that \({\hat{T}}_{n,1}- T_{n,1}=o_P (1)\), and thus, \({\hat{T}}_{n,1}\) weakly converges to \(\sup _{0\le s\le 1} | B^\circ (s)|\) due to (4).

Next, we deal with \({\hat{T}}_{n,2}\). Under the conditions of the Theorem 2.1, we first verify that (5) holds. Note that

wherein

because \({\hat{\sigma }}_t^2\ge 1\) for all t and

To deal with \(II_n\), we write \(II_n \le 2\sqrt{n}\|\hat{\varvec{\phi }}\| (II_{n,1} + II_{n,2})\) with

Note that

Moreover, as

on the event \(( |{\hat{\alpha }} - \alpha | \le \rho , |{\hat{\beta }} - \beta | \le \rho )\) with \(\rho <1\), whose probability tends to 1, for any \(N \ge 1\), we have

for some \(\lambda \in (0,1)\). Combining (12) and (13), we can easily show that \(II_{n,1}\le \frac{2}{n}\sum _{j=1}^{p} \sum _{t=1}^{n} |{\hat{\epsilon }}_t {\hat{\epsilon }}_{t-j}-\epsilon _t \epsilon _{t-j}| =o_P(1)\). Then, since \(II_{n,2}=O_P (1/\sqrt{n})\) by Donsker’s invariance principle for martingales (Billingsley, 1968), we have \(II_n = o_P (1)\). This completes the proof of (5).

Moreover, using (13), the invariance principle, and the fact that

we can see that

(see also Oh & Lee, 2018), which entails \({\hat{T}}_{n,2}-T_{n,2}=o_P (1)\) and the weak convergence of \({\hat{T}}_{n,2}\) to the supremum of the Brownian bridge. This validates the theorem. \(\square\)

Rights and permissions

About this article

Cite this article

Lee, S., Kim, C.K. Test for conditional quantile change in GARCH models. J. Korean Stat. Soc. 51, 480–499 (2022). https://doi.org/10.1007/s42952-021-00149-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42952-021-00149-x